Business.com aims to help business owners make informed decisions to support and grow their companies. We research and recommend products and services suitable for various business types, investing thousands of hours each year in this process.

As a business, we need to generate revenue to sustain our content. We have financial relationships with some companies we cover, earning commissions when readers purchase from our partners or share information about their needs. These relationships do not dictate our advice and recommendations. Our editorial team independently evaluates and recommends products and services based on their research and expertise. Learn more about our process and partners here.

Business Insurance Guide

This guide breaks down the basics of business insurance and what you should look for when searching for a policy.

Table of Contents

Running a business always involves some level of risk, and those risks can vary widely depending on your industry, size and operations. Business insurance helps protect your company from the potentially high costs of claims, lawsuits and other unexpected events.

Still, choosing the right type and amount of coverage can feel complicated. This guide breaks down the basics of business insurance and answers some of the most common questions business owners ask when deciding how to protect their companies.

Who needs business insurance?

Every business needs some level of insurance to protect against the costs that come with claims, lawsuits and damage to people or property. Customers, employees or other businesses could sue your company for many reasons, even if you did nothing wrong.

For example, a customer might slip on a wet floor in your office or have a bad reaction to a product or service you provide. Situations like these can lead to significant legal expenses. With business insurance, your policy would help cover attorney fees, court costs and any settlement amounts, no matter how the case is resolved.

Legally required insurance

Some types of business insurance aren’t optional: They’re required by law. The exact requirements depend on your industry, location and the nature of your work. For example, medical professionals must have medical malpractice insurance, while those in financial and investment work are usually required to carry professional liability insurance. Other businesses might sign client contracts that stipulate that they maintain errors and omissions insurance.

In addition, nearly every state requires businesses with employees to have workers’ compensation insurance. In fact, all states have specific laws outlining what employers must provide to protect employees who are injured on the job.

Do you need business insurance for a limited liability company (LLC)?

Forming a limited liability company (LLC) helps separate your personal and business assets if you face a lawsuit or insurance claim, but that protection can extend only so far. Your company’s assets can still be exposed to business lawsuits, and courts can pierce the corporate veil if you mix personal and business finances.

Business liability insurance adds another layer of protection, helping safeguard your company’s assets even when your LLC offers some personal protection.

What types of business insurance do you need?

Choosing business insurance can feel overwhelming because there are so many options, and the right coverage depends on your company’s size, industry and risks. Below are some of the most common types of business insurance:

- General liability insurance

- Commercial property insurance

- Commercial auto insurance

- Business owner’s policy (BOP)

- Business income insurance

- Professional liability insurance

- Errors and omissions insurance

- Product liability insurance

- Workers’ compensation insurance

- Cyber insurance

- Employment practices liability insurance

- Directors and officers insurance

- Commercial umbrella insurance

General liability insurance

General liability insurance protects your business from lawsuits and claims related to property damage or bodily injury. It helps cover the legal costs of defending your company, as well as any judgments or settlements that result from a lawsuit.

This coverage can also pay for repairs if an employee accidentally damages a client’s property while on the job, or for medical expenses if a customer is injured at your place of business.

Commercial property insurance

Commercial property insurance protects your business’s physical space and assets, like tools, equipment, furniture and inventory, from damage and loss. Standard policies typically cover events such as fire, lightning, explosions, windstorms, hail, smoke damage, vandalism and theft.

Many insurers now also offer optional coverage for floods and earthquakes, which traditionally required separate policies.

Commercial auto insurance

Commercial auto insurance protects your business if you or your employees are involved in an automobile accident while on the job, for example, if an employee gets into an accident while making a delivery in a company van.

This coverage is essential if your business owns or leases vehicles, or if employees drive their own cars for work-related tasks. It helps cover damages and liability costs resulting from accidents involving company or employee vehicles. [Read Related Article: Commercial Car Insurance Laws by State]

Business owner’s insurance

Business owner’s insurance, also known as a business owner’s policy (BOP), combines general liability and commercial property coverage into a single plan. It offers the protection of both policies but typically costs less than purchasing them separately.

Business income insurance

Business income insurance, also known as business interruption insurance, replaces income that’s lost when your business is forced to temporarily close its doors due to a fire, weather-related damage, theft, explosion or other events (as outlined in your policy). This coverage helps you stay afloat and pay ongoing expenses, like rent and payroll, so you can recover more quickly after an unexpected event.

According to the Federal Emergency Management Agency (FEMA), about 40 percent of small businesses never reopen after a disaster, which makes income-replacement coverage an important part of your business continuity plan.

Professional liability insurance

Professional liability insurance protects your business if a client claims you made an error, were negligent or misrepresented your services. This coverage helps pay for legal defense costs, settlements, judgments and other damages that can result from a lawsuit.

Errors and omissions insurance

Errors and omissions (E&O) insurance protects your business, employees and professional staff if a client claims your work was inadequate or negligent. This coverage helps pay legal fees, court costs and settlements up to the limits of your policy.

Product liability insurance

Product liability insurance protects your business if someone claims a product you sold, made or distributed caused injury, death or property damage. Like professional liability insurance, this coverage helps pay for legal defense costs, settlements, judgments and other damages that result from a lawsuit. It can also cover the injured party’s medical expenses related to the product.

Workers’ compensation insurance

Workers’ compensation insurance provides benefits to employees who become injured or ill while doing their jobs. It covers their medical expenses and lost wages while they’re out of work, as well as rehabilitation costs to help them return to work or find a new job.

This coverage also limits your company’s liability if an employee sues your business for a work-related injury or illness. How much workers’ comp coverage you need depends partly on your state’s laws and your workforce size and structure.

Cyber insurance

Cyber insurance, also known as cybersecurity insurance or cyber risk insurance, protects your business from the financial fallout of cyberattacks and other online threats. This coverage can help pay for data breach response costs, ransomware payments, business interruption losses and expenses related to regulatory fines.

According to Statista, the global cost of cybercrime is projected to reach $15.63 trillion by 2029, making this coverage essential for businesses of every size.

Employment practices liability insurance

Employment practices liability insurance (EPLI) protects your business against employee claims involving discrimination, wrongful termination, harassment or other workplace issues. This coverage helps pay for legal defense costs, settlements and judgments.

With employment-related claims on the rise, EPLI has become essential for any business with employees. In 2024, the Equal Employment Opportunity Commission (EEOC) recovered nearly $700 million for victims of workplace discrimination, a clear sign that employers face increasing legal risks.

Directors and officers insurance

Directors and officers (D&O) insurance protects the personal assets of company leaders if they’re sued for wrongful acts committed while managing the business. This coverage helps pay for legal defense costs, settlements and judgments stemming from lawsuits that allege breaches of fiduciary duty, mismanagement or failure to follow regulations.

Both public and private companies can benefit from D&O coverage, especially as personal liability claims against executives have increased in recent years.

Commercial umbrella insurance

Commercial umbrella insurance provides extra liability protection beyond the limits of your other policies. When a claim exceeds your primary policy limits, umbrella coverage kicks in to cover the remaining amount.

This policy typically extends over general liability, commercial auto and employers’ liability insurance. For businesses facing high-value lawsuits, umbrella coverage offers important added protection, often at a lower cost than raising limits on individual policies.

How much does business insurance cost?

Business insurance costs vary widely depending on your industry and coverage needs. According to recent data from Insureon and The Hartford, small businesses pay around $500 to $740 per year for general liability insurance, though costs can range from $400 to $2,000 depending on risk factors. A business owner’s policy typically costs between $680 and $1,700 annually, based on company size, location and risk exposure.

Many factors influence your premium, including the following:

- Type of business: High-risk industries like construction, healthcare and manufacturing pay higher premiums than lower-risk businesses such as consulting firms or online retailers. For instance, a construction company might pay three times more for general liability coverage than an accounting firm with similar revenue.

- Business size and number of employees or clients: Bigger businesses have more clients, employees and potential for issues, so they’ll need more coverage, which will increase costs.

- Coverage limits: Higher coverage limits mean more exposure for the insurer, so premiums will rise accordingly.

- Location: State regulations and local risk factors influence insurance pricing.

- Experience and years in business: Established businesses with a long track record and trusted reputation often pay less than newer ones with limited experience.

- Claim history: Companies with prior claims can see premium increases of 20 to 50 percent, depending on frequency and severity. Insurers use your loss history to predict future risk.

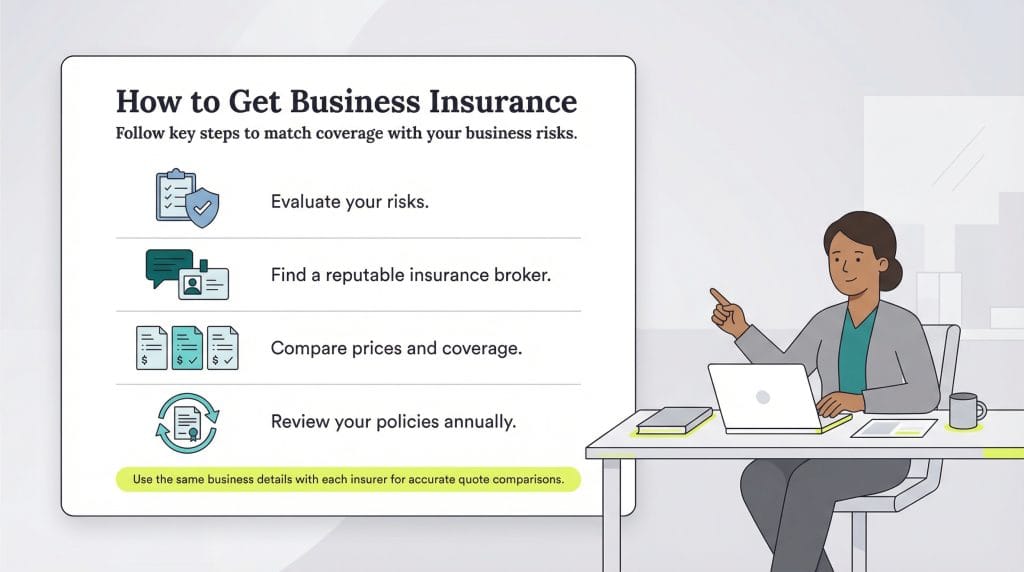

How do you get business insurance?

Getting business insurance starts with identifying your specific coverage needs, then contacting an insurance broker or provider that offers the right policies for your business. Before choosing a plan, take time to determine which types of coverage best fit your risks and operations.

Here are the key steps to follow:

- Evaluate your risks. Conduct a comprehensive risk assessment to identify potential liabilities such as physical assets, intellectual property, cyber vulnerabilities, employee-related risks and supply chain dependencies. Document specific scenarios that could disrupt your operations, from natural disasters to data breaches.

- Find a reputable insurance broker. Look for an independent commercial insurance broker who understands your industry and works with multiple carriers. Verify their license through your state’s insurance department and check for any complaints or disciplinary actions.

- Compare prices. Request quotes from at least three insurers, making sure each one includes the same coverage limits, deductibles and policy terms. Review exclusions carefully and ask about discounts for bundling policies or improving your cybersecurity and risk management practices.

- Review your coverage annually. Your risks and liabilities will evolve as your business grows. If you’ve purchased new equipment, entered new markets or opened a new location, talk with your broker to ensure your insurance still fits your needs.

How can you save on business insurance?

Business insurance costs can add up quickly, especially if you need more than one type of coverage. Follow these tips to help save money on business insurance and get the most value from your policies.

Work with your insurance broker

An experienced insurance broker acts as your advocate in the marketplace, using their industry expertise to help you secure the right coverage at competitive rates. They can spot coverage gaps you might miss, eliminate duplicate policies and explain exclusions that could affect your protection.

Brokers can also suggest risk management strategies that may reduce premiums over time. Stay in regular contact with your broker about any business changes; timely updates can prevent coverage gaps and may even help lower your rates.

Shop around

Every insurance provider offers different rates and coverage options. Comparing quotes from multiple companies helps you find the best fit for your business.

Reach out to insurance companies and brokers who have experience working with your industry. When you review quotes, make sure you’re comparing policies with the same coverage limits, deductibles and included services.

Check each insurer’s AM Best rating — aim for A- or higher — to confirm financial stability. You can also review complaint ratios through your state insurance commissioner’s office to see how each company handles customer issues.

Purchase a package

Packaged insurance policies, such as a business owner’s policy that combines general liability and commercial property coverage, are often less expensive than buying each policy separately.

Bundling multiple policies with the same carrier can result in discounts of 10 to 25 percent and makes claims processing easier since you’re working with a single insurer.

Increase your deductible

Raising your deductible can be a smart way to lower your premiums. For example, increasing it from $500 to $1,000 may reduce your costs by 10 to 20 percent, while going up to $2,500 could save 25 to 30 percent annually.

Before you make the change, be sure you have enough cash reserves to cover the higher deductible if you need to file a claim. Consider setting aside your premium savings in an emergency fund so the money is available when you need it.

Take action to prevent losses

Proactive risk management shows insurers that you run a responsible, safety-minded business, and that can lead to lower premiums. For example, installing business security systems with 24/7 monitoring may reduce property insurance costs by up to 20 percent.

You can also save money by focusing on everyday safety. For example, train your team regularly and keep simple records of your safety sessions — that’s often enough to earn workers’ compensation discounts. Make sure your equipment stays in good shape, your cybersecurity practices are up to date, and your staff knows what to do in an emergency. These small, consistent efforts can help prevent accidents, protect your business and keep insurance costs manageable.

Kimberlee Leonard contributed to this article.