Business Finances

Your money matters, and our Business Finances hub can help you more effectively manage it. From securing funding and tracking revenue and expenses to bolstering cash flow, these resources can help you build a sturdy foundation for your fiscal house.

Expert Business Financial Advice, Tips and Resources

The Best Financial Products and Services

Accept credit and debit cards to make it convenient for customers to purchase from your business.

Credit Card Processors

Increase sales by offering customers the flexibility to choose how they pay your business.

Merchant Services

Understand financing options and choose the right ones to start or grow your business.

Business Loans

More Best Picks

Trending Financial Articles

Why Small Businesses Need Online Payment Apps

Fewer people are relying on cash and want to use different methods, like online payment apps, to purchase items.

From Collections to Repossession: A Timeline of Debt

Debt collection occurs in phases and, although it can seem overwhelming, there are options for relief.

Everything to Know About Business Checking Account Fees

Business checking account fees can eat away at your profits and affect your cash flow if you aren't careful. Before you choose a business checking account, make sure you know what fees it may charge.

Latest: Advice, Tips and Resources in Finance

Article

Should You Pick the Cheapest Payroll Service?

By Sean Peek | March 06, 2026

QuickBooks, Rippling, Gusto and Zenefits are among the cheapest payroll services that also boast a range of features for small businesses.

Article

How to Create and Send Invoices With PayPal

By Jennifer Dublino | March 06, 2026

Want to send a professional invoice via PayPal? Follow this guide to learn how

Article

What Is a POS System? (And Other Common Questions Answered)

By Skye Schooley | March 05, 2026

You've been told you need a POS system, but how does one work, how can it benefit your business, and what are its advantages over a cash register?

Article

What Are the Benefits of POS Systems for Restaurants?

By Donna Fuscaldo | March 05, 2026

From tracking inventory to running promotions, restaurant POS systems bring numerous benefits. Learn about the top features of restaurant POS systems.

Article

How Much Does a POS System Cost?

By Jamie Johnson | March 05, 2026

Price is a key factor for many businesses when evaluating POS systems. Here’s what you might pay for a POS system and some good options to consider.

Article

Should Your Restaurant Accept Bitcoin?

By Mark Fairlie | March 05, 2026

Some restaurants have started accepting Bitcoin as payment. Learn the pros and cons of accepting Bitcoin in restaurants and how to get started.

Article

Unsecured Small Business Loans for Startups From $50,000 to $100,000

By Donna Fuscaldo | March 05, 2026

Every new business needs capital, but starting out with a large amount of debt can be a burden. Here's a rundown of small loan options to consider.

Article

Need a Loan? Lending Trends That Are Increasing Your Chances of Getting the Funds You Need

By Jennifer Dublino | March 05, 2026

From tighter lending criteria to the rise of payment processors, many changes are underway in small business lending.

Article

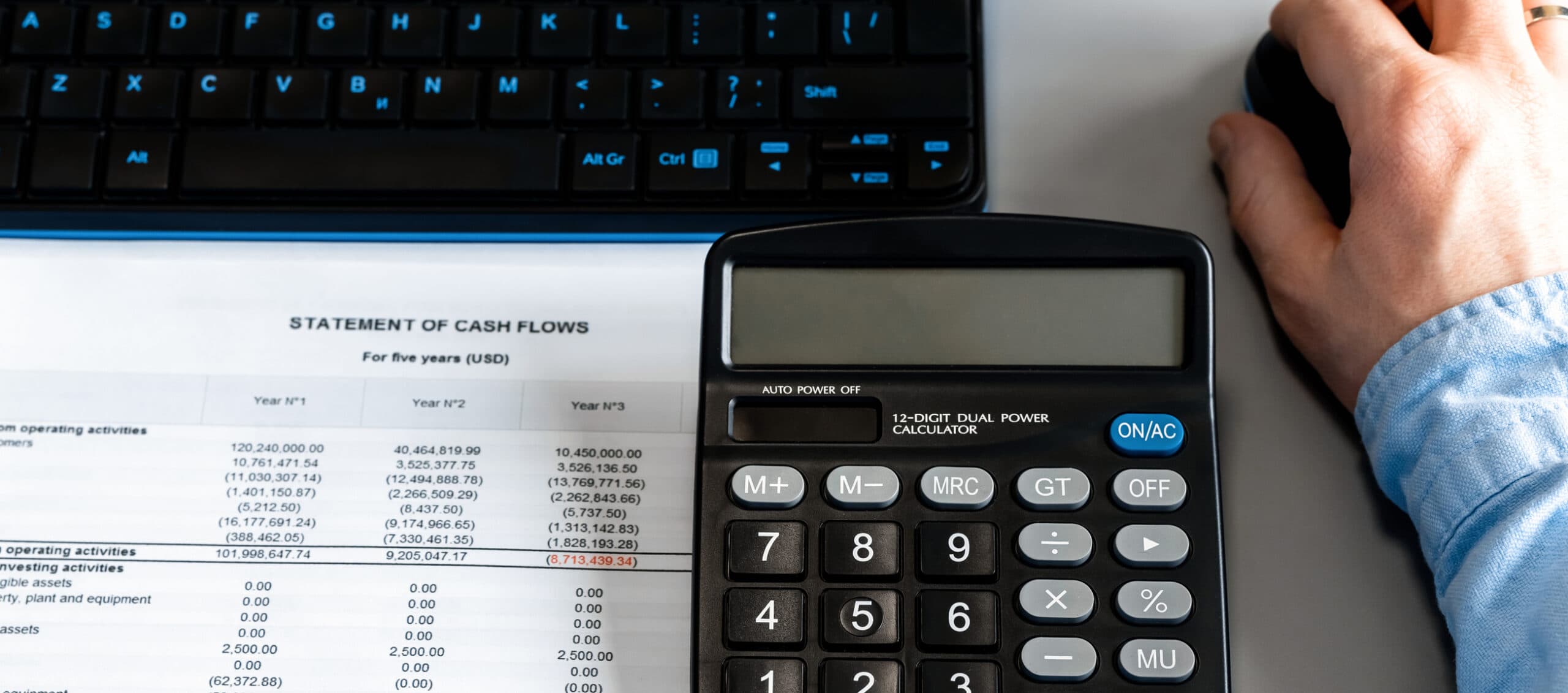

How to Get Your Business Loan Application Approved

By Donna Fuscaldo | March 05, 2026

Get your business loan approved by maintaining strong cash flow, credit scores above 650, organized financial records, and a detailed business plan showing ROI.

Article

When Does Your Business Credit Score Matter?

By Donna Fuscaldo | March 05, 2026

Your business credit score is related to but separate from your personal credit score. Learn what a business credit score is and why it matters.

Article

18 Small Business Grants for Minorities

By Adam Uzialko | March 05, 2026

Business grants help provide free funding to minority business owners. Check out the most updated list of minority business and how to apply.

Article

What’s the Difference Between a Grant and a Business Loan?

By Skye Schooley | March 05, 2026

Learn whether a grant or loan is better for your business, the different types of each, how to choose between them and the best loan providers.

Article

How to Calculate Loan Payments

By Mike Berner | March 05, 2026

When considering accepting a business loan, it's important to develop a repayment plan. Learn about the calculation formula, amortization and more.

Article

How Business Debt Consolidation Works

By Julie Thompson | March 05, 2026

Learn who should consider debt consolidation and what you need to know before deciding whether business debt consolidation is right for you.

Article

How to Find and Attract Business Investors

By Mark Fairlie | March 05, 2026

Need an investor to help grow your startup? Here's how to find an investor and what to look for.

Article

Types of Fast Business Loans

By Max Freedman | March 05, 2026

Find out which fast lending methods you can choose from when you need a business loan and what you need in order to apply.

Article

Everything to Know About Farm Equipment Loans

By Donna Fuscaldo | March 05, 2026

Farm equipment is costly, and for many in the agriculture industry, it's imperative to find affordable financing. Read our guide on farm equipment loans.

Article

Bookkeeper vs. Accountant: What the Differences Are & Why You Need Both

By Dachondra Cason | March 05, 2026

Understanding the distinction between accountants and bookkeepers can save your business a lot of money.

Article

Fixed and Variable Expenses: What Do These Terms Mean?

By Sammi Caramela | March 02, 2026

Find out the definitions and see examples of fixed, variable and mixed expenses. Read on to learn how to save on these costs.

Article

Venmo for Business: Is It Right for You?

By Jennifer Dublino | February 26, 2026

Venmo for Business lets small businesses accept payments easily with low fees, quick setup, no approval needed and access to a large, young customer base.

Article

Hitting the Books: A Guide to Retail Accounting

By Jill Bowers | February 26, 2026

Learn about the methods of calculating and tracking inventory that are used in retail accounting.

Article

How to Decide Which Type of Business Loan Is Right for You

By Donna Fuscaldo | February 26, 2026

Finding the right sources of funding for your business can be difficult. Learn how to choose the right one for you.

Article

Types of Business Loans and How to Choose

By Donna Fuscaldo | February 26, 2026

Learn how to choose the best business loan for your unique business.

Article

How to Apply for a Business Credit Card

By Dock David Treece | February 25, 2026

A business credit card has distinct advantages, like simplified accounting. Learn how to choose, apply for and qualify for a business credit card.

Article

How to Wrap Up Your Fiscal Year and Start the New One Right

By Max Freedman | February 25, 2026

Follow these tips to end your fiscal year the right way and kick off your next one primed for success.

Article

How to Accept Credit Card Payments for Small Businesses

By Adam Uzialko | February 25, 2026

Accepting credit cards requires a payment processor like Square or Stripe, a merchant account, and hardware like POS terminals. Fees range from 1.5% to 4%.

Article

K-1s and How They Are Used

By Jennifer Dublino | February 24, 2026

Partnerships use schedule K-1 tax forms to avoid tax penalties by distinguishing business income and personal income.

Article

Small Business Credit Card Processing: What You Need to Know in 2026

By Elizabeth Crumbly | February 24, 2026

Credit card processing allows businesses to accept debit and credit card transactions, boosting sales and customer satisfaction in the process. Here’s how it works.

Article

Which Is Better: Cash- or Accrual-Based Business Accounting?

By Sean Peek | February 21, 2026

Cash- and accrual-based business accounting are two methods for tracking financial performance. Learn which is right for your business.

Article

How to Reconcile a Business Bank Account

By Dock David Treece | February 21, 2026

Learn how to reconcile your business’s bank account by comparing your recorded transactions to the bank statements. Then, you can follow up on any errors.